Happy Thursday!

We'll happily reply to any direct emails if you have questions about the terms below (i.e., what is #ReFi), feedback, or article suggestions.

Here’s your regular snapshot of our burgeoning ecosystem:

Global Ecosystem News 🌊

Fundraises

⚡ iEX, a Korean renewable energy trading platform, announced its $1.6M Seed fundraise from BNK Venture Capital and High Investment Partners.

⛓️ 5ire Chain, a layer one blockchain creating infrastructure for UN SDG-focused projects, received a $100M commitment from GEM Capital ahead of its IPO.

🚢 Plug and Play launched a $25.5M fund to invest in supply chains, backed by US investors, including the Walmart family office.

Ecosystem News

⛓️ Algorand, a $4.5B market cap cryptocurrency, announced that it built carbon offsets into its transaction fees.

The international NGO, Inter-American Development Bank, reported using blockchain technology to track $23B in green bond purchases.

🌱 Google's philanthropy arm donated $2M to support the Integrity Council for Voluntary Carbon Markets.

🌅 UAE based Fasset, a digital asset exchange operating out of Dubai Multi Commodities Centre, is tokenizing solar energy loans to create sustainable “low-risk” investment options.

New Startups 🚀

Founders, feel free to submit your project here.

🌻 Energy Web, a crypto protocol, and ENGIE Energy Access, a major utility, are launching an investment product to crowdfund African clean energy projects. Stakers (akin to investors) in the smart contracts may earn a 10% return on their capital.

👨🏭 Decarb.Earth, a South Africa-based startup, is using tokenized loans to help small businesses fund decarbonizing their operations.

Curated Readings 📚

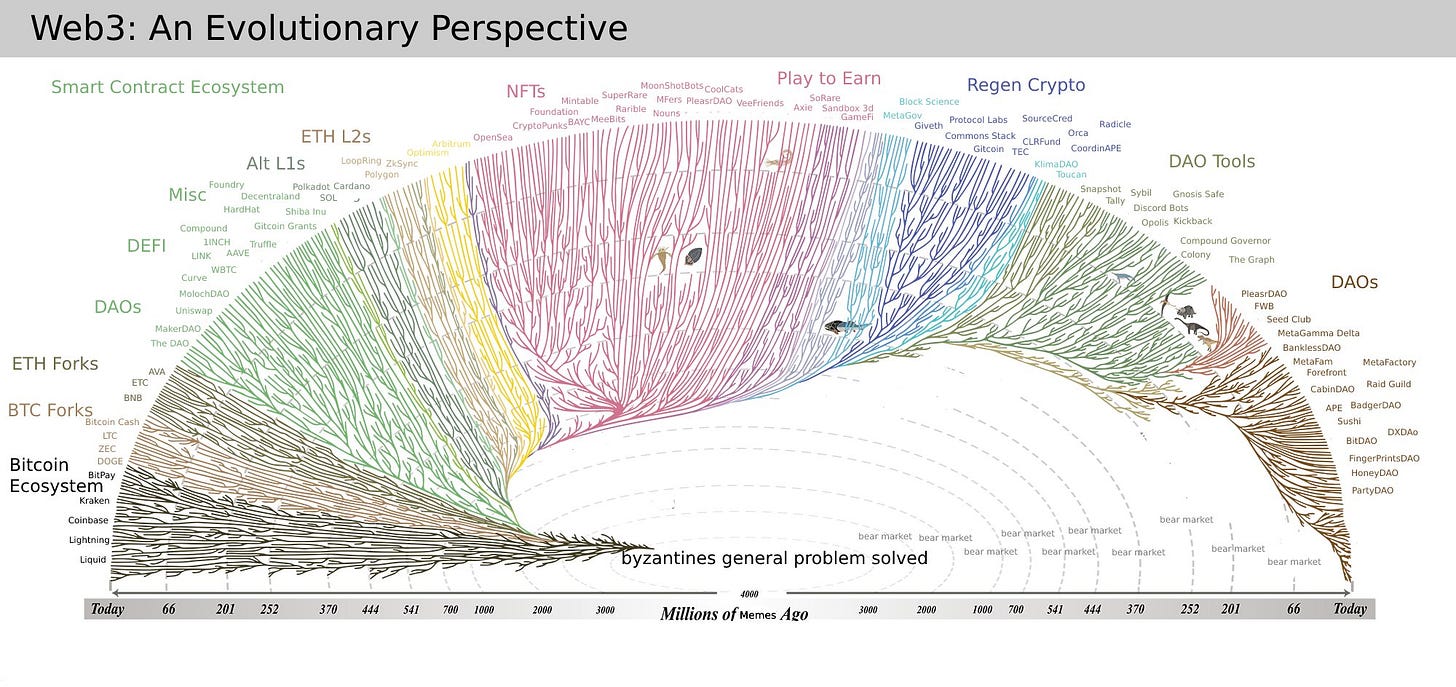

1 - Evolution as a model for web3’s failures: Kevin Owocki, the founder of Gitcoin DAO, wrote this 4-minute blog discussing the crypto industry through an evolutionary lens. He also created this beautiful rendering applying the tree of life photo to web3:

P.S. Want to add your notes on prior failures in blockchain startups? Alex is creating this open-source repository for web3 climate investors.

2 - Eight Blockchain Startups Leveraging Data to Advance Climate Action: dClimate — a startup that facilitates the sale of climate data for other web3 projects — wrote this blog covering eight #ReFi startups. The article does not offer clear explanations of the startups’ products or business models, but it is interesting to reference for investors.

3 - Beyond GDP for the Wellbeing Economy: If you're interested in examining alternatives to GDP, this is the best concept overview we’ve seen. After working on GDP with the UN, OECD, and World Bank, the author condenses the movement's history into this 11-page summary. Why is it relevant to web3 climate investors? Within traditional climate science, there are increasing calls to model economics after the sustaining (regenerative) patterns we see in nature. GDP has been a metric that economists and policymakers often prioritize. Yet, GDP’s usefulness has come under increasing scrutiny in the last two decades. Many #RegenerativeFinance crypto projects explore how cryptoeconomic design can create new “micro-economies.” Understanding better alternatives to GDP is necessary as these #ReFi startups emerge.

P.S. Thank you to Duke climate researcher Will Reynolds for the initial recommendation and his notes on the report.

Bonus for Aspiring Founders

Learn How to Build a Crypto Company — a16z launched the videos from their crypto startup school. For tech folks and founders new to web3, the discussions from crypto experts make for a great introduction to web3 business models, how founders can navigate the idea maze, and designing tokenomics.

We read every email response if you’d like to submit articles, your investment insights, or particularly relevant news.

With love,

Alex Filotimo and Aera Force contributors

Researching web3 venture investments for a flourishing future

P.S. If you want to help drive research into web3-climate startups, Alex created this open-source insights repository.

This newsletter is for educational purposes only. While we strive for accurate and unbiased information, none of it is verified or intended to help as investment advice.